Buy or Lease a Car - Advantages and Disadvantages

Gotten a new job that requires you to drive? Or are you having a new addition to your family and are considering getting a car so that it makes getting to and fro places much more convenient? Honestly, there’s a lot to consider when thinking if you should be purchasing a car. Some of you may also think that it is cheaper to lease a car instead. But is it really?

Gotten a new job that requires you to drive? Or are you having a new addition to your family and are considering getting a car so that it makes getting to and fro places much more convenient? Honestly, there’s a lot to consider when thinking if you should be purchasing a car. Some of you may also think that it is cheaper to lease a car instead. But is it really?

In this guide, we will be looking at the costs of owning and leasing a car, and analysing the advantages and disadvantages of both options. Then again, costs are not all that it is when comparing between these two options. You’ll always want to take into consideration your lifestyle choices. For instance, how often you drive the car and whether or not you have a preference for a certain brand of car.

For a start, we will be using the Toyota Vios 1.5G Grade as an example to compare these two ways! Assuming that you either buy a car or lease a car for a period of 5 years:

Monthly Installment (based on period of 7 years at 2.78%)

$81,988 (10 years)

$817 / month

$81,000 (5 years)

- Road Tax

$3,430 (5 years)

Included in leasing costs

- Estimated Car Insurance

$5,000 (5 years)

- Maintenance and Servicing

$2,500 (5 years)

$24,596

$300

Note:

- Estimated values rounded off for ease of comparison.

- This table is a simplified version to compare buying a car and renting a car

- The rental for Toyota Vios 1.5 G would likely be an older model

An all-new Toyota Vios costs $81,988 and it will be with you for a total of 10 years. In comparison, renting a Vios at a monthly contract of $1350, would cost roughly the same in 5 years.

Even though the costs itself make buying a car much more worthwhile, there are other prices that one must take into account such as maintenance and servicing charges and road tax that car owners would have to bear. Additionally, car owners will need to purchase their own car insurance whereas most rental car companies would already have some form of insurance for their rental cars. Such charges that car owners will have to bear may still not be as expensive as renting a car daily in the long run (say 5 years).

✔ Buy a car

For instance, if you do not have too much upfront cash, renting a car is a more economical option, as most rental car companies only require about a few hundreds as a form of deposit. Buying a car, however, you’ll need to make about a 30% down payment, which will be a lofty $24,596 for that Toyota Vios. Hence, for those without upfront cash, renting a car will be much better.

Alternatively, you may also wish to consider buying a used car. Since the costs for these cars are lower than the prices of new cars, the down payment would also be much lower.

✔ Rent a car

The frequency in which you drive the car would also be a factor to consider when selecting your options. If you drive your car every day, then buying a car makes more financial sense in the long run. However, if you are only requiring the car during a particular period of time in your life or if you are a frequent traveller, then car rental may suit you better. Depending on the type of lease that you choose (day, week, month). You can stop renting the car after the minimum period is up. As such, if you are looking only to drive for a year, then paying $16,200 for a rental car is much better than purchasing a car only to sell it only after one year.

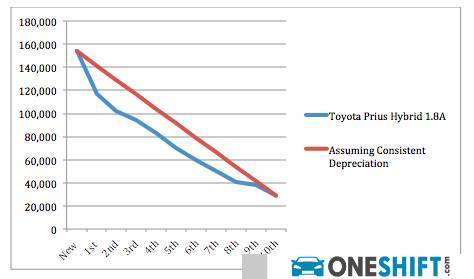

As you should already know, depreciation of cars is not regular and consistent throughout its 10-year lifespan. If you sell your car within the first three years, the new car will likely depreciate at a much higher rate, not to say within the first year!

You may also be interested in: When is the best time to sell my car? Understanding the depreciation of cars in Singapore.

✔ Drive often and/or for long term – Buy a car

✔ Drive infrequently and/or for short term – Rent a car

Also, if you have a certain preference of car that you would enjoy driving, sometimes you may not find that particular model in the car rental market. Also, you may have to drive a much older car than you would like.

Then again, renting a car would give you the ability to change make and models of cars frequently. It may be a way for first-time drivers to get used to different cars before purchasing their first car?

✔ Particular make and model – Buy a car

✔ No particular make and model – Rent a car

Finally, car enthusiasts will definitely know that the feeling of owning a car is totally different from renting a car. How would you then measure that?

Cheaper in the long run if you drive the car every day.

Affordable for occasional drivers. Rent a car on Carousell from $45 a day (there may be cheaper ones if you look hard enough!).

You’ll get to choose whichever brand of car you like (depending on your budget)

Drive with less upfront cash

You may be able to sell off your car for a good price after 5 years.

Leasing costs include maintenance, insurance, etc

Having your own car is not the same as renting a car for car enthusiasts. The feeling of driving your own car is unmeasurable!

Ability to stop rental at any time after the contract

Ability to change cars often

High upfront cash required

More expensive in the long run (for a period of 5 years)

Additional costs that need to be borne by car owner aside from the cost of the car

If you prefer a particular brand of cars, you may not be able to get that in the rental car market and you may end up with older cars.

The car is a depreciating good, you may make a loss if you sell within the first three or first five years.

All in all, whether or not you would like to buy or lease a car, it really depends on one’s needs and lifestyle patterns. Consider wisely your financial situation and your needs before you buy a car or lease a car!

Credits:

- Convenient and Hassle-Free

- Consumer Protection

Transparent Process

With No Obligation

Get the Best Price for your used car

from 500+ dealers in 24 hours