8 things you need to know before renewing your COE

Owning a car is expensive in Singapore with all the taxes and the 10-year Certificate of Entitlement (COE). Even when COE is low, many car owners may choose to renew their COE rather than purchasing a brand new car, especially when their cars are still in great condition. But what are some other considerations before you decide whether you should renew your COE?

Owning a car is expensive in Singapore with all the taxes and the 10-year Certificate of Entitlement (COE). Even when COE is low, many car owners may choose to renew their COE rather than purchasing a brand new car, especially when their cars are still in great condition. But what are some other considerations before you decide whether you should renew your COE?

The Certificate of Entitlement is the ownership right to a vehicle in Singapore and it allows you to drive your vehicle on Singapore roads for a period of 10 years.

At the end of the 10-year period, car owners will have to decide between renewing their COE and sending their cars to the scrap yard. After weighing your options and you decide that you would like to renew your COE, you will need to pay a Prevailing Quota Premium (PQP) to extend your ownership of the vehicle and right to use it on Singapore roads for another 5 or 10 years. Unlike purchasing a new car, you do not need to bid for COE. Instead, you will have to pay for the Prevailing Quota Premium (PQP) to renew your COE.

This PQP is the moving average of the Quota Premium COE prices within a 3-month period.

Want to have MAS regulated bank loans with transparent and the lowest fee? Renew with Oneshift today!

For a five year COE renewal, you’ll pay 50 per cent of the PQP and will definitely have to scrap your car once the 5-year term is up. The extension of 10 years meant that you’ll have to pay the full PQP and you can still choose to renew your COE for another 10 years when it expires. You can refer to the latest COE results to check for the latest COE or PQP.

Like most other things in Singapore, planning is key and it is always always best to plan ahead. When you are studying, you have to plan which university to go to, which internship to plan for and which job to go to. After that, if you wish to get the best deal for your marital home, you’ll have to plan 3 – 4 years in advance when applying for a Build-To-Order flat. Similarly, if you wish to renew your COE, you will want to weigh your options around 6 to 10 months ahead to ensure that you make an informed decision.

During this period of time, you can take the chance to seriously consider if you would like to scrap your car or to renew your COE. If you renew your COE, do note that you will lose your car’s PARF rebate. The PARF rebate is an amount that you get back from the government when you deregister your car. It is calculated based on your leftover COE and the Additional Registration Fee (ARF). While the PARF rebate is not that much for Asian cars and forgoing it may even help you save more as compared to purchasing a new car, continental cars have a much higher PARF value.

For instance, a 2008 Honda Civic 1.6A may have an ARF of about $21,000, which means that you will forgo about $10,500 in terms of your PARF rebate. Comparatively, a BMW 5 Series’ ARF is about $45,000 and you will then forgo $22,500 of PARF rebate.

Should you still be deciding whether you should scrap your car or renew your COE, you may also be interested in: When my COE expires, should I scrap or renew my COE?

During this period of time, you should have already make the decision if you should renew your COE or scrap your car. This 2 to 3 months should be a period of time in which you should be kept updated on the latest COE updates.

Do note that your payable PQP rate is for the exact month that your 10-year COE expires. Should you choose to renew before your COE expires, it will follow the PQP rate at the time of renewal. If you are seriously considering this option to renew your COE, a good strategy will be to renew it when the PQP rate is low.

For instance, if your COE expires at the start of September, wait till the PQP of September comes out (usually during the third week of the previous month: August) and if PQP of August ($40,000) is lower than that of September ($42,000), you should renew it during the third week of August before your COE expires. This would grant you a savings of $2,000.

That being said, if you have renewed your COE before your pre-existing COE expires, the new COE will commence from the 1st of the following month that you have paid your PQP and the remaining pre-existing COE will be . So do calculate your costs accordingly before you renew your COE.

For car owners who forgot (oops) that their COE is expiring, don’t worry, you still have 10 working days left to get a COE renewal loan and renew your COE online.

During this period, you have no choice but to pay the PQP during the point of application and will not be able to leverage on any lower prices before or during the month of your COE expiry.

If (touchwood) you can’t get your COE renewal loan within this period of time, don’t worry as you still have one last chance to renew your COE before it is considered a scrap vehicle.

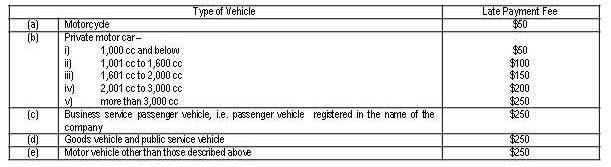

Although the Land Transport Authority (LTA) permits a grace period of 30 days from the expiry of your COE, it will be subjected to a late payment surcharge. Furthermore, if you do not have any road tax or car insurance for your vehicle during this period of time, it is considered an offence for your vehicle to be out on Singapore roads. Should you not renew it even after this grace period, the car will be considered a scrapped car immediately.

Credits: LTA’s Late payment surcharge

This method is only possible if you have that upfront amount in your bank account. You will just have to apply for a renewal of your COE and pay the PQP.

However, this is also not quite a straightforward decision as it depends on various factors as to whether the full cash payment is an advantage or not to the car owner. Before deciding to self-finance, you will need to take into consideration your other life plans such as getting married, purchasing a house, starting a family, any other investment plans, as well as setting aside some cash-on-hand for those rainy days. Do take one step back to weigh your options objectively and rationally!

Like purchasing a new or used car, there are various loan arrangements available to help finance your COE renewal. One of which are COE renewal loans offered by the banks. The Monetary Authority of Singapore (MAS) regulates bank loans and the maximum loan repayment term is 7 years for a 10-year COE renewal and 5 years for a 5-year for a COE renewal.

Before you renew your COE, ensure that you look out for financing options roughly before you would like to renew your COE. This time frame is necessary as it takes up to 7 working days for loan approval and 3 working days for the renewal process.

If you were to settle the loan earlier than what was previously agreed, most banks would offer an interest rebate that would seem to cover the penalty of returning the amount earlier. However, don’t be fooled to think that it is better to settle the loan earlier. The rule of 78 refers to the way in which interest rates are calculated to maximum the interest paid at the start of the loan that ultimately minimises any savings from settling your loans earlier.

Read more about the rule of 78 here.

The cost of financing would be spread evenly across the period of installment

Banks usually apportion majority of the chargeable interest to the start of the loan.

R = [n(n+1)]/[N(N+1)] x TC

R represents the interest charges rebate;

n represents the unexpired loan period expressed in months;

N represents the original loan period expressed in months;

TC represents the total amount of interest over the loan period.

For instance, you have a six-year COE renewal loan of $40,000 at 3 per cent that you wish to fully pay it up after 24 months. Assuming that the bank utilises the Rule of 78 to calculate the interest rebate, with a 20 percent early repayment penalty on the rebate.

: $40,000

: 3% per annum

: (3% x 6 years x $40,000) = $7,200

: 72 months

: ($40,000 + $7,200) / 72 = $655.55

: 24 months

: $655.55 x 24 months = $15,733.2

: [48(48+1)] / [72(72+1)] x $7,200 = $3,221.92

With the calculations, $3,221.92 is the unpaid interest on the leftover 48 months from early termination of the loan.

: 0.8 x $3,221.92 = $2,577.54

: $40,000 + $7,200 - $15,733.2 - $2,577.54 = $28,889.26

: $28,889.26 + $15,733.2 (total amount that is already paid) - $40,000 = $4,632.46

Looking at these figures, even if you would pay the loan earlier by 3 years, you would have already paid $4,632.46 out of initial $7,200 (64.3%) that you would have to pay. On top of that, you will also have to fork out the early settlement penalty (differs from bank-to-bank).

As such, it is not that you should not opt for early settlement as there are still advantages to doing so, but it is important to note the rule of 78 when deciding your loan tenure.

Oneshift works with the best COE loan providers to help you to get a COE renewal loan with competitive interest rates and affordable monthly payments.

As banks are usually more stringent in their loan application, there are a plethora of financiers in the market that you can secure a loan. Loan consultants are available to assist you in the complicated renewal loan processes and these financiers usually have shorter approval time. Should you wish to secure a loan much faster as compared to banks, you may wish to consider in-house financing.

That being said, these loans may come at a much higher interest rates than those from the banks. Easy things don’t come free!!

You may also be interested in: 5 Singaporean Car Financing Schemes/Scams

Whichever option that you choose, do consider the pros and cons wisely and get financing options from a reputable bank or financier.

Oneshift provides a one-stop COE renewal loan for your convenience

Now that you have gotten your loan secured, you can renew your COE by completing the application to renew your COE and paying the PQP to the Land Transport Authority (LTA) via the following modes (Do note that each method has various processing time that should be also considered before you renew your COE):

In today’s technological world, this is probably the preferred way to extend your vehicle’s COE. To pay the PQP online, you will need a valid Internet banking account with either:

- DBS/POSB

- OCBC/Plus!

- Citibank

- Standard Chartered Bank

- UOB

You will also need to ensure that there are sufficient funds in the account and the payable amount is within your daily Internet payment limit.

If you choose to pay the PQP by post, you will need to ensure that it is done at least two weeks before your COE expiry date. For whichever PQP period that you decide to renew, the application form and payment should also reach LTA by the end of the month of that PQP period.

As such, the application date is the date in which LTA receives the application. They would also take the earlier date as to deciding the PQP payable (date of application vs COE expiry date).

Should you decide to head to the LTA Customer Service Centre, you can choose to pay via cheque, cash, cashier’s order, Diners Club Card, or NETS. Again, for the last two payment options, you will need to ensure that the payment does not exceed your daily transaction limit.

For cheque payments, the COE will only be renewed upon the clearance of the cheque. Should the cheque be dishonoured, there will also be an administration fee levied to process the dishonoured cheque and to cancel your COE renewal application.

For payments made during the 1-month grace period, only cash, cashier’s order or NETS payment is allowed and an additional late payment fee will be imposed.

All is not completed after all these processes; you will still need to pay your road tax surcharge. For cars over 10 years old, there will be a road tax surcharge that increases by 10 per cent each year after your first 10-year period up to your 14th year of having the vehicle. Subsequently, you will have to pay a 50 per cent surcharge every year up till the end of your COE term.

This would mean that you will pay an additional $120 for the road tax (about $1200) of your Nissan Teana 2.0A after the 10th year, and $600 when it hits the 15th year mark.

Besides renewing your COE, you will also need car insurance to keep you covered in the event of any incidents. Rather than just renewing your car insurance, this is also a good time for your to reassess your options as there may be more compelling policies than what you have purchase a decade ago.

A common misconception of many car owners is that car insurance premiums are a lot higher than that of new cars. However, this is not necessarily the case. In fact, car insurers often charge higher premiums for new cars for their comprehensive plans. But, do also note that there will be fewer car insurers for cars that are past 10 years.

To help you save the time taken for extensive research in getting the best quotes, Oneshift works with various car insurers and offers free non-obligatory car insurance quotes.

If you want your car to last for another 5 to 10 years, you may need to consider the following and these costs need to be considered:

If your mileage exceeds 250,000 km or it has started to consume more engine oil, or worse if it has excessive smoke emitting from the exhaust, you will need to consider overhauling your engine.

Sometimes older cars tend to vibrate more at traffic lights and in traffic jams when it is stationary. Changing the engine mounts could help to reduce this problem.

Give this a good check and it may need an overhaul after 10 years of being on the road.

Have your car inspected by a workshop to find out what needs to be replaced. To ensure that you do not unnecessarily change working parts, get a second or third opinion. Preferably, this should be done prior to deciding whether you would like to renew your COE. The following are some of the parts that usually require replacement after 10 years:

- Power steering

- Brake hoses

- Cooling system piping

- Fuel injector system

- Radiator

- Water pump

- Brake pump

- Brake discs

- Caliper seals

- Suspension – dampers and linkages

With all these, we are sure that the daunting task for renewing your COE doesn’t seem that challenging now. You will also be more informed in your decision as to when and how you should renew your COE. So now that COE is at an all-time low, what are you waiting for?

Do you need a COE renewal loan? Oneshift works with the MAS regulated banks to bring you the lowest COE renewal loan! To start the processes of getting a COE renewal loan, fill in the following form and Oneshift’s friendly customer service will get back to you at the earliest instance!

Credits:

Get the Best Price for your used car

from 500+ dealers in 24 hours

- Convenient and Hassle-Free

- Consumer Protection

Transparent Process

With No Obligation