5 Ways Singaporean Motor Insurers Reject Your Claim

A rejected claim is every driver’s worst nightmare. Here’s 5 ways it could happen.

Right, so, driving under the influence is an offence under the Road Traffic Act. Section 67 of the Act stipulates that a person may be guilty of drink-driving if, while driving or attempting to drive a motor vehicle on a road or public place, he is found to be incapable of having proper control of his vehicle, or the proportion of alcohol in his breath or blood exceeds the prescribed limit.

But more pertinently, you’ll realise that your own insurance policy sets out very detailed and specific terms of coverage. Most policies have clauses defining your legal responsibilities to others – third parties – and you’ll find that there’s a clause for non-coverage if your vehicle is driven by anyone under the influence of alcohol, drugs or medication.

If your own insurance won’t cover you when you’re drunk driving, that means if you are hit by someone who was drunk-driving, his insurance won’t pay up, either.

But how do you prove that the other party was drink-driving? Long and short of it – don’t report the other party to the police, because a police report that confirms drink-driving gives the offending driver’s insurer the evidence it needs to prove that coverage conditions were breached.

You’ll also notice that your insurance policy (I know, it’s a lot of fine print) has a clause that says it won’t pay out if your car has modifications that are not approved or reported to the Land Transport Authority.

The General Insurance Association of Singapore says that you must inform your insurer if you make any modifications to your car. Many insurers consider modifications made to a car as material information in deciding what premium to charge for a policy; some insurers may also not wish to insure modified cars.

What’s modification and what isn’t?

Says the GIA, “Modification refers to changes made to a car which are directly related to how it operates as a car. This includes changes to engine performance, drive train, air intake systems, exhaust systems, transmission systems, or any changes to the handling characteristics of the car including suspension systems, strut towerbars, or bracing as well as any changes made to the control unit of such parts. This list is not exhaustive.

Routine maintenance where like-for-like parts are used, that is in accordance with the manufacturer's standard specifications, will not be considered as modification.

Accessories are parts of your car which are not directly related to how your car operates and will not impact your insurance coverage. This include upholstery, audio equipment, multi media equipment, communication equipment, personal computers, satellite navigation and radar detection systems, provided they are permanently fitted to the car and have no independent power source.

Changes made to rims/tyres and body kits are not considered a modification when they are within the manufacturer's defined and acceptable specifications. However please note that in case of any damage during an accident, insurers will only replace or repair with suitable part(s) in accordance with the manufacturer's standard specification.

If you require further clarification, please contact your insurer.”

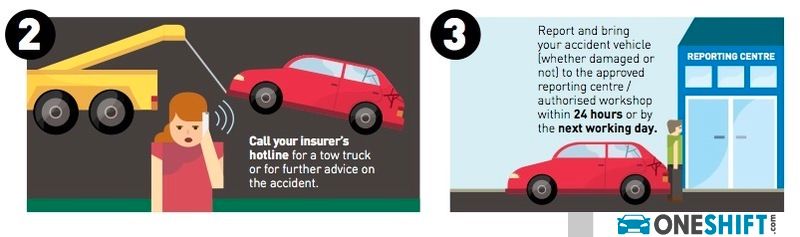

Under the Motor Claims Framework devised by motor insurers in Singapore, failure to report an accident to them within 24 hours will affect your No Claims Discount and prejudice your claim. Your insurer may even deem you to have breached policy condition and hence reject your claim completely.

What if the other party fails to report the accident? Well, don’t worry about it. Your insurer or workshop will do the necessary legwork needed to ensure that the offending party pays, up to and including hiring a lawyer to go after the driver in civil court if his own insurer rejects his claim (due to his own breach of policy condition).

This is of course, provided that you have made the original report on your end, with the photographic evidence, accident plan and driver’s details as required under the Motor Claims Framework, which proves beyond a doubt that the accident did take place. In that case, good luck to the other guy!

Last but not least, you may have a rejected claim if you are using your vehicle for commercial purposes, whilst having insurance coverage only for private use.

Now, all of the above cases involve claiming against another party’s insurer or your own insurer. What if the other party isn’t covered by insurance, or has for some reason has his insurance cover voided by his insurer (see points 2, 3, 4 and 5)?

Then, my friends, it’s time for a civil case. The only way to get compensated for your losses would be to engage a lawyer and go after that driver in court, in the hopes that he has enough money to pay for all your damages and also cover your lawyer’s fees.

Unless, that is, your insurance policy covers against the exact scenario of the other party having his insurance voided, which has never, and will never happen. This is why I tell my friends to always buy comprehensive insurance, with a NCD cover. If there’s ever any activity where you need insurance to be as extensive and as comprehensive as possible, driving is it.

For example, an ex-colleague of mine lost control of the company van while turning into a filter lane in slightly moist conditions. He broke the vehicle's front axle, suspension and ruined the rims. No other party was involved.

But because the company van was only covered by 3rd party insurance, he had to pay for all of the repairs himself, leaving him three thousand dollars out of pocket just before he left for a holiday in Europe.

A Traffic Policeman was along shortly at the accident scene to tell him that he was lucky he didn't damage any government property - ie. kerb, tree or lamp, otherwise he would have had to pay for those as well. So, still think 3rd party cover is good enough?

And then, there's my other ex-colleague, who was rear-ended on the expressway. In his official report, the offending party claimed that she had swerved into his lane. With no onboard camera footage or witnesses to provide collaborating evidence, the insurer rejected her 3rd-party claim, making her 50% liable for both her own car's damage and the other party's.

C'est La Vie! Such is life!

Credits:

- Convenient and Hassle-Free

- Consumer Protection

Transparent Process

With No Obligation

Get the Best Price for your used car

from 500+ dealers in 24 hours