5 Things to Note Before Buying a New Car in 2015

After a home, purchasing a car is indeed one of the biggest purchases you will probably make. There are many cars on the market, and there are plenty of cars to suit different budgets but buying the right car, is of course the most important. This guide will help first time car buyers make the right choices and buying the right car.

Over the past few years, with the implementation of many new policies and schemes, we have seen many changes in the new and used car industry.

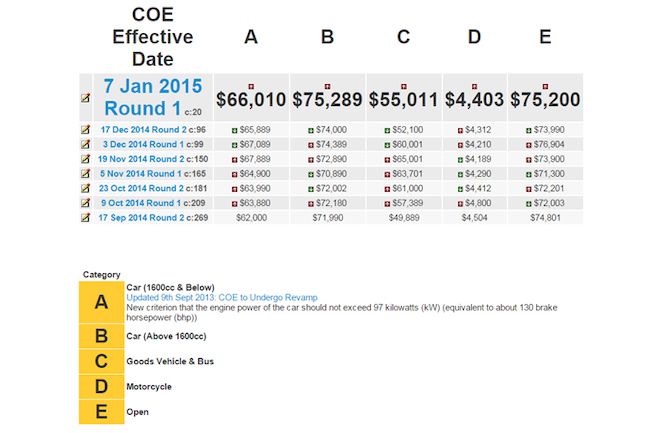

In 2010, we have seen COE prices start its climb as the grip on COE allotment tightened, from about $20,000 in Jan that year to its peak of $93,000 in January 2013, before settling down to the $70,000-$80,000 region in recent months.

2013

2013 saw the implementation of the CEVS (Carbon Emission-Based Vehicle Scheme). Cars with high carbon emissions were charged an additional surcharge, increasing the payable ARF, and conversely, cars with low emissions were instead given rebates to their payable ARF. However, it is important to note that the CEVS will only last till 1 July 2015, something car buyers who plan to purchase during that period will have to take note of.

In the same year, the tiered ARF (Additional Registration Fee) structure was introduced. For the first $20,000 of a car’s OMV, the ARF was charged at 100%, the subsequent $30,000 at 140%, and any excess above $50,000 at 180%. This has caused high-end cars to become more expensive to purchase by a substantial amount, while lower end cars have had little or no changes in price.

In addition, the ‘Special Tax’ charged on top of road tax for Euro V-compliant diesel vehicles was reduced by a third to $0.20 per cc of engine capacity for every 6 months, down from $0.625. This lower additional tax makes the purchase of diesel cars, which are more economical and cheaper to fuel than petrol counterparts, more attractive.

Early in the year, MAS announced that it would make a host of changes to the private car loan. For cars with OMV of $20,000 and less, loans would be capped at 60% of the car’s value, whereas for those with OMV above $20,000, the percentage was capped at 50%. The tenure of new car loans was also capped at 5 years instead of the previous 10. Shortly after these restrictions kicked in, there was an increase in interest rates for car loans, from 1.88% to 2.88%.

2014

In February 2014, a new change was introduced to the COE system in a bid to make it more equitable, CAT A COE was limited to cars below 1600cc and below 97kW (or about 130 hp). This move pushed many CAT A turbocharged sub-1600cc cars that were once cheaper to buy into the CAT B category.

2015

In mid-January, it was announced that COE quota for the period of February to April would see an overall increase in supply over the period of November to January, good news that car buyers want to hear.

For the current COE period, the quota was set at 11,932, while for the period from February, the quota is at 14,114, an overall 18.3% increase.

Category A COE would see the largest rise in monthly quota during this period, rising from 1,396 of the previous to 1,973, a 41.3% increase.

Category B COE would also see a healthy increase of 26.9%, rising to a monthly quota of 1,444 from the current supply of 1,138.

Category E COE, usually used for cars belonging to Cat B, sees a dip of 33.8%, from 527 to 349. Combining Cat B and E, the total monthly quota from these 2 categories will benefit from a net increase in monthly quotas of 128 units, or a meagre 7.68% increase.

As long as the increase in supply of COE is not met with a proportionate (or more than proportionate) increase in demand, we can expect to see a dip in COE prices. Category A COE will perhaps see the largest change in price, and conversely Category B and E will likely see little change.

Following the introduction of the tiered Additional Registration Fee (ARF) and 50% loan-to-value limit tenure of new cars last year, car ownership has become even more difficult against the already sky-high COE. The higher payable ARF from the tiered ARF system means the more expensive cars are dearer to buy. Since most buyers of new cars will take out a loan, they face the challenge of only being able to borrow half the car’s sale price.

Moreover, with interest rates currently at 2.88% and COE prices not seeming to plunge in the near future, purchasing a new car is a task that requires much capital and the ability to afford the monthly upkeep.

Not only does a buyer have to consider the purchasing costs, but there are other major ownership costs such as fuel bills, maintenance, insurance and road tax to be considered too.

The cost calculator tool from LTA is a rather good indicator of your ownership and running costs.

Perhaps going for a cheaper, lesser-powered model might make more financial sense if you are uncertain about affordability.

If new cars are still too dear, you may consider buying used. Not only do you perhaps get the car you wish to have, they’re easier on your pocket too.

Based on your needs for the car and personal preferences, choose the type of car that you think suits you best. You may yearn for a Volkswagen Scirocco, but with a family with 2 growing young kids, it would perhaps be wiser to go for a 5 door hatch or sedan instead. If you have a large family, perhaps you’ll need something bigger like a Volkswagen Sharan or a Honda Odyssey.

Do you drive in crowded places often? Is your workplace/home car park tiny and a pain to manoeuvre in? If so, perhaps a smaller car might fit the bill for you.

A good time to buy would be when dealers are clearing stocks of previous model year or pre-facelift models. Newly released models often command a higher price at the shop floor, hence if you not mind having a slightly older model, then great deals can be had.

When the price of COE falls, the prices of the cars will fall too. If the COE prices fall but the car price doesn’t, negotiate for a healthy discount. Oneshift has a useful page for COE price history and charts.

Pay little attention to roadshows, promotions, and discounts, most are ploys to draw you in, as prices are inflated before being given a “discount”. So, shop smart and look out for the real promotions.

At the showroom, bring your family members along with you. They may provide feedback on the car that may well be very important.

Other than test-driving the cars have narrowed down, it is also wise to test drive something at the higher rung of your budget or just above your budget. You will understand what you are missing out on, and perhaps make better judgement on your original car of choice.

Would it be better to go for a higher trim level that comes with the extra gizmos and toys or stick to the basic trim level? It’s up to your budget and preference. Oneshift has a very handy loan calculator to help you make decide your budget.

Now, you have a firm idea of what car you want and need most. What colour would you like? Black and white show up dirt and scratches easily, but again this is really up to your preference and availability of stock, which brings us to our next point.

Most dealers carry a ready stock, and if you’re not willing to wait three to six months for your new car, then buying from this ready pool of stocks would be most ideal. Some dealers might be willing to give deeper discounts to clear stock that they can’t sell, such as cars in less desirable colours such as red.

Finally, while you are at the showrooms check out the financing deals and options available and do the calculations on your own. Occasionally, you may get a great deal on financing and perhaps even end up getting a more premium car for less than you expect.

When you’re ready to buy, be firm and do not hesitate to walk away from the deal if you do not feel comfortable. Some salespeople may be pushy, and if there is a need to, approach another salesperson to complete the deal.

Of course, no sweet deals are complete without discounts, so ask for a discount. If the salesperson is willing, ask for more discounts.

If they are not willing to budge, do not hesitate to ask another salesperson. On top of discounts, ask for freebies, such as solar film, servicing vouchers, car interior mats, or the likes.

Now that you’re comfortable about the deal and all the details are settled, it’s time to sign on the line, and wait in anticipation for the arrival of your new car.

Credits: Wang Shirong

- Convenient and Hassle-Free

- Consumer Protection

Transparent Process

With No Obligation

Get the Best Price for your used car

from 500+ dealers in 24 hours