Ride-Share is Dying

When a company is powerful enough to take away your incentives and control transportation inflation by simply disrupting and killing off its competition, it is only a matter of time before it starts to throttle back driver incentives.

Right until... Uncle… turn left here

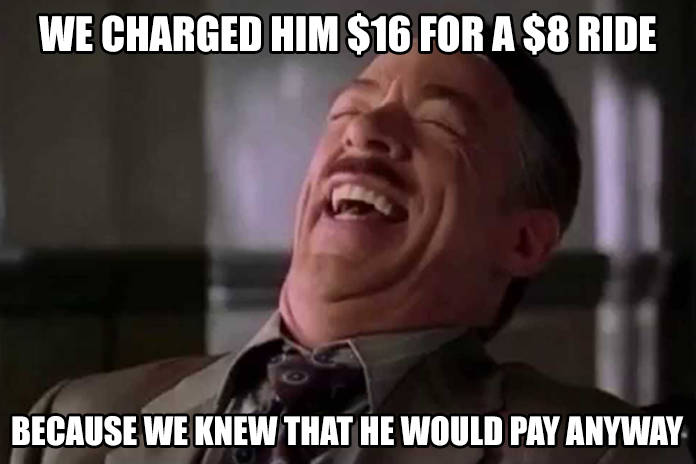

As the incentives are throttled down like Malaysia’s internet, there is that initial shock and anger on increasing ride pricing. With Uber gone, there is no reason to dish out incentives to get you to use the ride hailing apps as there is almost no other way. You can queue for a taxi – but good luck getting one?

The public may be accustomed to it – but prices are starting to rise slowly and unconsciously at times rising higher than back in those days of regular taxi hailing. Peak hour surcharges can hit amounts so ridiculous that they subtly indicate that it is time for you to go queue and flag a regular cab. Yet there is nothing we can do – and even the Competition Watchdog couldn’t stop Grab’s Infinity Gauntlet from snapping and dissolving Uber forever.

The good thing remaining though is the rewards points which can be used to exchange for Grab discounts, among other things. As other ride-share apps such as Ryde and Go-Jek try and get a piece of the pie discarded by Uber – Grab seems barely worried as it has bigger plans. To become the super app that can consolidate a lot more services than just rideshare. Will it put Grab off if people stop or reduce booking rides nowadays?

The bigger question remains from all the de-incentivization and price hikes. If demand goes down - do the big pool of drivers still make as much as they used to? Do drivers, besides claiming nobody tells them what to do, still make absurd claims of making good money driving taxis? Or was that all really part of a huge recruitment drive incentivized by driver referral bonuses?

Never mind the questions on ride-hailing apps. Take a look at the COE.

For a few years the COE was artificially inflated with taxi and rental car fleet buying, renewals and expansion – all in the name of upcoming disruptive mobility tech. A $50k COE was once normal – and worse, blamed on regular car buyers for being too greedy and keeping the demand high, when in actual fact, it was the companies that were taking out loans to keep their fleets expanding.

Once VES kicked in, Prius and other popular hybrids suddenly became too expensive for fleet companies to purchase for taxi use. Lion City Rentals bucked from the debt for over-buying cars and having them to rot in the lots with insufficient drivers to use them. The buying slowed down and COE prices climbed a few rungs down to 38-40k range from the 50k highs.

However other factors threaten to keep it still relatively well inflated – such as 0% vehicle growth, recent addition of 200 hybrid Hyundai Ioniq taxis to ComfortDelgro’s fleet and the stricter VES from July that takes into account additional pollutants besides CO2.

The aggressive expansion of ride-sharing, the coupon competition to force competitors out of business and the over-buying of COEs to fill up rental fleets is all coming to an end. Most ride-sharing apps are now focusing on the next big IoT projects.

Ride-Sharing apps know when you travel, which places you head to and at what times of the day, your price sensitivity – whether you choose a cab at a certain price or wait it out, your behaviour patterns depending on weather, events, etc. With that they have mapped out an entire algorithm specially for you – and knowing your patterns and behaviour is far more valuable than charging you for a ride.

When a company is powerful enough to take away your incentives and control transportation inflation by simply disrupting and killing off its competition, it is only a matter of time before it starts to throttle back driver incentives. Less discounts lead to less demand and then drivers will see less incentives. Car rental rates are not impacted by any of these factors and people are starting to become more sensitive towards their privacy settings. It doesn’t take Dr Strange to figure out that the near future will only see fewer fleet expansions.

The only winner from all this - probably healthier COE prices.

With all these restrictions – and a promised look into keeping a separate COE quota for cars intending to go under private hire, it might actually be either really close or cheaper to just buy your own car. However fret not, as the June period may actually see a small spike just to clear those really pollutive cars before the 2nd VES kicks in.

With all this in mind, how relevant is ride sharing in the near future?

Credits:

- Convenient and Hassle-Free

- Consumer Protection

Transparent Process

With No Obligation

Get the Best Price for your used car

from 500+ dealers in 24 hours