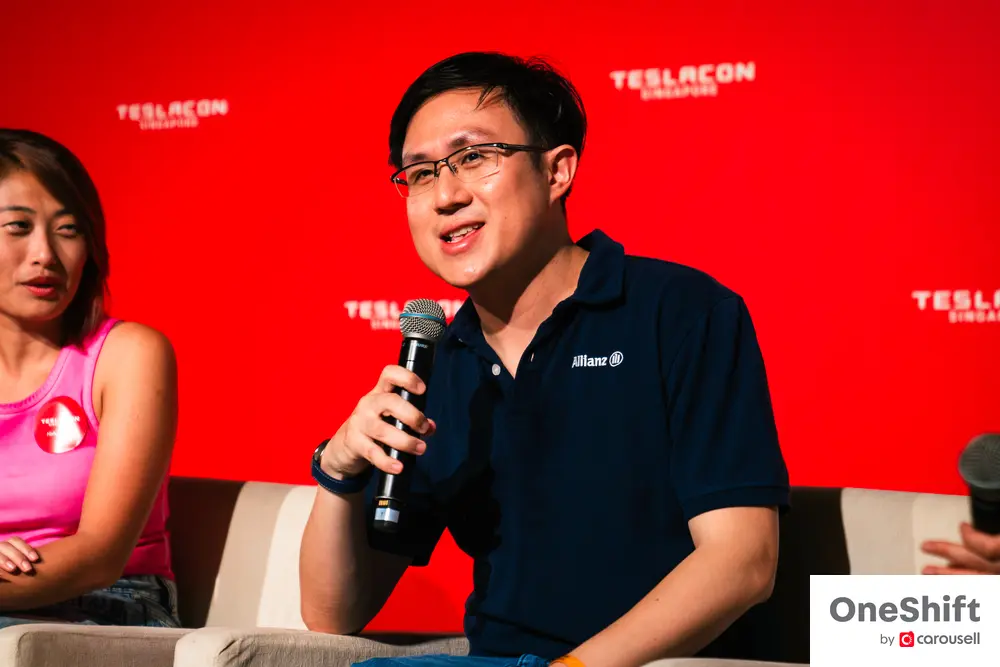

"Our goal is to help people along their electrification journey": Jing Yean Wong, Chief Technical Officer of Allianz Insurance Singapore

Allianz launches Electric Motor Protect, an EV-specific insurance policy that is catered specifically for the needs of EV owners.

When Tesla first entered direct sales in Singapore, the first thing many new Tesla owners told me was how shocked they were about the high insurance premiums.

I was curious why Tesla insurance was significantly higher than other cars in its price range. A few vague factors were thrown about, like self-driving risks and so on. However, it was never defined clearly. I later realised that it is commonly known in the industry that electric vehicles typically cost more to insure than ICE vehicles. Why? Aren’t EVs meant to have lesser mechanical parts and therefore easier to run and maintain? I was determined to find out.

I got my chance at TeslaCon SG. For those not in the know, TeslaCon SG took place last month which was entirely volunteer-run by Tesla enthusiasts. It was where we were invited to speak to Jing Yean Wong, Chief Technical Officer of Allianz Insurance Singapore, in conjunction with the launch of Allianz’s Electric Motor Protect, an EV-specific insurance policy that is catered specifically for the needs of EV owners.

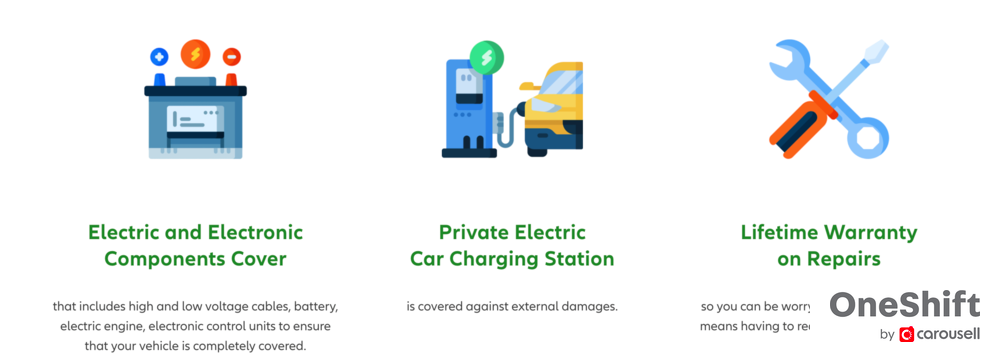

Why would you need an EV-specific insurance policy? Well it makes a lot of sense. Firstly, EVs have a lot more electronics. Allianz’s policy covers components such as high and low voltage cables, battery, electric engine and electronic control units. It leaves in no uncertain terms what is covered and what is not, which is a welcome change for many EV owners.

Allianz’s policy also covers any external damages at private EV charging stations. So if something happens while charging, for example, and your car gets damaged, this is covered. If you need to get your car fixed, with precious few workshops authorised to work on EVs (there are only three authorised to work on Teslas in Singapore!), Allianz offers lifetime warranty on repairs.

Lastly, one thing many people don’t consider is how cyber hacking is becoming a real risk for EVs that are fully digital and connected. Well, Allianz covers any loss or damages caused by malicious cyber acts, even when using any assistance systems.

Jing Yean shares more about EVs, the industry and Allianz’s approach in general:

Why did Allianz launch Electric Motor Protect?

I would like to share some perspectives on why Allianz decided to enter the insurance space. Despite Singapore's efforts to promote the use of electric vehicles (EVs), the number of EVs on the road is still relatively low. When Allianz introduced its EV insurance product early last year, there were only about a thousand electric vehicles on the roads out of a total of approximately 650,000 vehicles in Singapore. This means that EVs make up less than 1% of the vehicles on the road.

Allianz was keen to enter this space for two reasons. Firstly, we are committed to the sustainability agenda and believe that the electrification of vehicles is an important part of this journey. Singapore is actively promoting the use of EVs, which makes it an exciting market to be part of.

Secondly, the Singapore Government has an ambitious plan to electrify all vehicles by 2030, known as the Singapore Green Plan. We want to be a part of this initial wave to establish our brand and support those transitioning to electric vehicles. Our goal is to help people along this journey and ensure a smooth transition to a greener future.

EVs are known to have more risk with regards to battery fires, perceived or otherwise. Has Allianz observed this to be the case, and if so, has it affected insurance premiums?

Many people worry about the risk of fire in electric vehicles since they are powered by batteries and contain a lot of electrical components. However, research and statistics show that the occurrence of fire in electric vehicles is lower than in traditional combustion vehicles, both regionally and globally.

Globally, the occurrence of electric vehicle (EV) fires is lower than that of combustion vehicles. Though EV fires still happen, and when they do, they tend to be reported more frequently in the media than combustion vehicles. Therefore, the perceived risk of EV fires is higher than the actual risk. From a statistical perspective, the difference in fire risk between EVs and combustion vehicles is not significant enough to affect insurance premiums.

However, owning an EV does come with new risks, such as damage that may occur during charging. Additionally, the digitisation and electrification of the software in EVs make them more advanced than traditional cars.

New risks have arisen with the advent of autonomous driving modes and the potential for hacking of vehicle software. It is important to consider whether claims can be made in these situations. In our policy, we explicitly cover any claims that arise during autonomous or assisted driving modes. We also exclusively cover losses, damages, or accidents that occur because of cyber hacking. Our objective is to offer a product that provides affirmative coverage for these new risks associated with owning and driving an electric vehicle.

Does this Electric Motor Protect policy apply only just to Singapore or is it offered regionally?

Insurance products are usually underwritten at a local level, and every country has its own regulations on what can and cannot be offered. Depending on the country's laws, insurance companies may need government approval and be required to follow specific tariff or wording guidelines. At Allianz, the product development phase is mainly driven by local factors.

As a large multinational group, we draw upon a plethora of ideas and developments from both the local and global markets. For instance, when it comes to electric vehicles, the most advanced markets aren’t found in Asia. Within the Allianz Group, we have a sister company called LY (Liverpool Victoria) in the UK, which is one of the pioneers in the field of EV insurance globally. Therefore, while designing our product in Singapore, we have taken advantage of our UK insurer's extensive experience, coverage and policy wording.

You mentioned the insurance covers some software portions. While driving an electric vehicle recently, there was an OTA update, and afterwards the aircon stopped working for me. So does the insurance cover these kinds of glitches?

Insurance does not cover air conditioning units that break down due to glitches or software issues. In the Allianz policy, we cover any loss or damage arising directly or indirectly from Cyber Hacking of your vehicle systems. Specifically, we do not cover any software malfunction.

Why is EV insurance generally costlier?

I would like to explain further about the risks associated with electric vehicles (EVs) compared to traditional combustion engine vehicles. Although EVs do come with new risks, they are not necessarily the main reason why insurance premiums differ. If we break down the components of an insurance premium, the biggest part is the claims that are paid out. There are two primary factors that determine the amount of the claim we pay out:

There is a term we use for the likelihood of a vehicle getting into an accident – frequency. For instance, if we say that a vehicle has a 10% frequency, it means that there is a 10% chance that the vehicle will be in an accident in a year, which will result in a claim.

The second aspect of an insurance claim is known as "severity". Essentially, this refers to the cost of the claim if it were to occur. In the case of an electric vehicle, we have noticed that the severity tends to be higher than that of a traditional vehicle. This means that the cost of repairing an electric vehicle is generally higher.

The cost of repairing an electric vehicle (EV) is often higher than that of a conventional car. This is due to a few reasons. Firstly, spare parts for EVs are more costly as they come with more electrical components such as sensors and cameras. Secondly, repairing an EV requires expertise and certification, which can raise the labour cost.

In fact, workshops that specialise in EV repairs look quite different from regular car repair shops. They are much cleaner, with no engine oil stains on the floor, and the technicians work primarily with electrical components.

Additionally, repairing an EV can take longer than repairing a conventional car, which also contributes to the higher cost. To summarise, the main reason for the difference in insurance costs between EVs and conventional cars is the higher cost of EV repairs.

Is it not because EVs are generally faster and more powerful?

Regarding the impact of cars being more powerful or faster, it typically affects the frequency of accidents. The main reason why insuring an electric vehicle (EV) is still more expensive is due to the severity of accidents, which is the cost of repairing an EV.

Like you mentioned, the technicians need to be certified. So is there a choice for EV owners to repair their cars in a third party workshop? Or do they have to go back to the authorised dealer (AD)?

The ability to repair a vehicle is still dependent on the policyholder's choice. However, not all workshops may have the necessary certification or willingness to repair certain vehicles. This is the reality. For instance, in Singapore, other than Tesla’s own workshop, there are only 2 other workshops authorised to repair Tesla vehicles. Therefore, it's crucial to consider the expertise and certification of individual workshops before choosing one for vehicle repair.

Do you think that the gap will ever close between non-EV and EV insurance costs?

I certainly hope so. As electric vehicles (EVs) become more popular, the cost of repairing them will likely decrease. This will happen as more workshops become available to repair EVs and more spare parts become available. Right now, there are fewer EV workshops, and spare parts for less common EVs can be hard to find, which drives up the cost of repair. So, the overall cost of repair is the key factor here. Additionally, EVs are typically equipped with more safety features, which could lead to fewer accidents and lower insurance premiums for EV owners.

How do insurance costs for EVs change as a car gets older? For example, for older cars in Singapore, maybe it's more difficult to get a comprehensive cover. So, is this the same for an EV?

When a car ages, the cost of insurance usually goes down because the overall value of the car reduces. This is seen in cases of total loss, where the insurance payment would also be reduced. This trend is also observed with EVs. As the car ages, we expect insurance issues to decrease because the overall value of the car goes down.

Many insurers are hesitant to offer comprehensive coverage to vehicles that are 10-15 years old because of the economics of repairing an older vehicle. Although the value of the car reduces, the cost of repairing it doesn't reduce proportionally. The cost of spare parts and repairs remains the same, so once the car reaches a certain age, the total value of the vehicle may no longer give any economic benefit to repair.

At the moment, there aren't many old EVs in Singapore. So, we cannot tell from a statistical perspective whether EVs would follow the same trend. However, my view is that it shouldn't differ very much from a normal vehicle as well for EV.

Are EVs perceived to be higher risk versus ICE cars by insurers?

Electric vehicles (EVs) come with a lot of safety features that can reduce the likelihood of accidents and resulting claims. Therefore, the risk associated with an EV can be lower. However, the cost of repairing an EV is higher compared to traditional vehicles, which drives up the insurance premium. It's important to note that the risk profile of an EV is different from that of a traditional vehicle. As more EVs hit the road and we gather more statistical data, we will learn more about the risks associated with EVs and reduce the uncertainty. The less uncertainty there is, the lower the overall risk. From a frequency standpoint, EVs should have a positive impact on the occurrence of accidents and claims. The increased safety features and sensors in EVs can prevent accidents from happening.

Do you currently have insurance policies for hybrids?

Within Allianz, we provide coverage for all types of petrol, including hybrids, plug-ins, electric vehicles, and traditional combustion vehicles. We offer two main sets of policies - the normal motor policy and the electric vehicle policy. Currently, most of our hybrid vehicles are covered under our normal retail motor policy.

The premiums for Tesla's versus other EVs tend to be higher. So, do you see this to be true?

It's quite difficult to find a direct competitor for Tesla in Singapore as they seem to be in a league of their own. The closest competitor would probably be BYD or BMW, but they still represent a different segment of driver profiles and vehicle specifications. When it comes to determining the price of an insurance premium, there are a few key factors that come into play. Firstly, the vehicle itself - its value, safety features, spare parts cost, repair cost, etc. Secondly, the driver - their age, driving experience, and NCD portion are all major factors that determine the cost of the insurance premium. These are the two biggest components that drive insurance premium costs.

For Model 3 and a BYD Seal, would the premiums be comparable?

I think Tesla might be more expensive due to higher repair costs.

Do you estimate the repair cost from the manufacturer?

We base our analysis on actual data and also learn from other regions and markets. When comparing the average cost of repair by brand, we found that Tesla's cost is 10 to 15 percent higher than BMW's. The difference is more significant when compared to Japanese brands.

But what if we talk about other EV brands in comparison? So we know Tesla is a bit more expensive. Let's say compared to Polestar or to the other Chinese brands, what's the comparison?

Currently, we have limited data available. The insurance premium is a dynamic factor that we have revised over the years. In case we observe a decline in repair costs for Tesla, it will directly impact the insurance payments and lead to lower payments in the future.

If an EV driver wants to buy a policy from Allianz, can he still choose a non-EV policy?

It's common for people to insure their electric vehicles using a regular retail motor policy. However, at Allianz, we don't offer that option. Instead, we limit the policies you can purchase based on the make and model of your vehicle. For electric vehicles, you must purchase an electric vehicle policy. You won't see a Tesla listed in our regular motor policy options because we believe that electric vehicles represent a different type of risk that requires specific coverage and policy wording. We want to be sure that we have the right products in place to protect our customers from the unique risks associated with electric vehicles.

Anything else you would want to add?

The current electric vehicle (EV) population in Singapore is only 2% of the total cars on the road. However, if we look at new registrations, EVs represent 20% of newly registered cars every month. In fact, in September, this number was even higher at around 22%. According to the LTA stats we definitely see more and more EVs. This is a significant increase, especially considering Singapore's plan to maintain a 0% growth in the car population. Despite this, there has been an exponential growth in the number of EVs on the roads. This shows a clear transition towards EVs, even within a 0% population growth plan. In Allianz we are very excited about this trend, and playing our part as an insurer that is supporting this transition.

Photos by Allianz and James Wong

---

Selling your car? Whatever the reason, caryousell@carousell, sell your car at the highest price today.

Get the Best Price for your used car

from 500+ dealers in 24 hours

- Convenient and Hassle-Free

- Consumer Protection

Transparent Process

With No Obligation