Goodbye Tesla, This. Is. Singapore.

Compared to 2011 when Tesla decided to pull out without selling a single car, the brand is a lot more valuable today and the demand for Tesla cars have grown much stronger since.

Singapore has faced plenty of misrepresentations – be it Chow Yun-fat welcoming the Pirates of the Caribbean crew or Criminal Minds: Beyond Borders portraying Geylang to be similar to Hong Kong’s Kowloon Walled City. Back in 2015, Mr Joe Nguyen made negative headlines when his imported Tesla model S was slapped with a $15,000 emission surcharge. Even Tesla’s boss, Elon Musk, stepped in to ask our PM what was going on. LTA sat on the case for a while and didn’t change its stance. Singapore was now in the limelight for absurdly slapping a pollution surcharge on a world-renowned green vehicle.

Importing a used car, like many other models, have a whole different set of rules to follow. In Mr Joe’s case, LTA had worked out the battery’s efficiency to be less than that stated by the manufacturer when brand new and was deemed to be consuming a lot more wH / km. This put it in the bad range of the CEVS band. It is unlikely to happen to someone buying a brand new electric vehicle in Singapore.

Under the new Vehicle Emissions Scheme (VES) this year, LTA announced that the emission factor to be used for computing the carbon dioxide (CO2) emissions of electric vehicles (EVs) and plug-in hybrid vehicles (PHEVs) has now been revised from 0.5g CO2/Wh to 0.4g CO2/Wh.

While it may not seem to make much sense as it still means that electric vehicles are being treated as pollutive based on the coal they burn to produce electricity, the calculations put them in generally good brackets.

So why did one of the hottest automakers on the planet exit our EV-friendly Singapore?

When the revisions to the Certificate of Entitlement categories started to factor in performance, electric cars generally fell into that of larger cars. To compound the issue, high performing electric cars such as Tesla models face heavier taxation due to their high-performance figures.

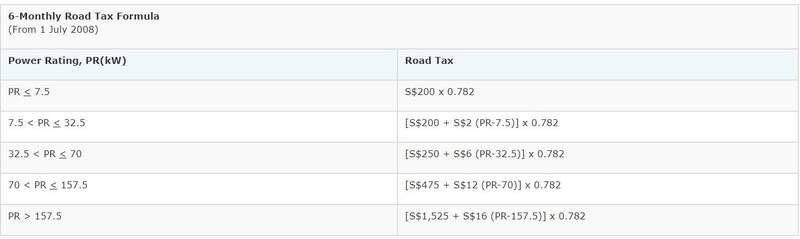

At present, the road tax for hybrid (petrol-electric) cars and electric cars is based on the engine capacity or in the case of purely electric – the power output in kW, whichever is higher.

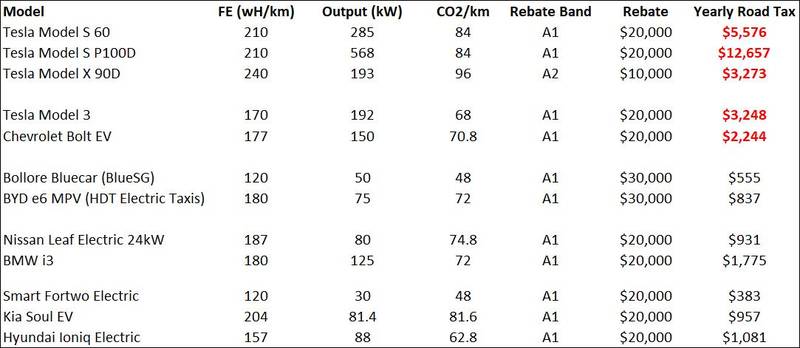

This complex formula, puts almost all of Tesla Models in hefty yearly road tax ranges. Even the upcoming Tesla Model 3 still sits in a slightly uncomfortable road tax range that are closer to 3 litre diesel engine cars.

Note: Taxis enjoy a higher VES rebate

While the BMW i8 (not shown in table) is a really expensive vehicle and sits in supercar price ranges, it is a hybrid (not pure electric) with a 1.5 turbo petrol engine and a mere 7.1 kWh electric motor that outputs 98kW. It would have attracted an even smaller road tax for its 1.5L engine but since the electric motor output is higher, it currently attracts a yearly road tax of $1268. The BMW i3’s electric motor in contrast has a bigger output of 125kW.

The 4th generation Prius’s electric motor outputs just 52kW – which equates to a $574 yearly road tax. However, since it has a 1.8L gasoline engine, the higher displacement-based road tax applies.

The current tax structure makes it difficult to purchase popular EV cars that are known for fantastic performance – the biggest pull factor for EVs over conventional cars. Despite the savings from running on electricity versus petrol, the road tax quickly adds up to negate the savings.

Provided that Tesla decides to make a comeback with the Model 3, with the $20,000 VES rebate, the Model 3 should retail at roughly $140,000 given current COE prices. At the current electricity price of 21.56 cents per kWh and assuming a monthly 1500 km of driving, that will cost only $55 each month. In contrast, it would cost a very efficient 1.0L Audi A3 Sedan in the same price range about $157 in fuel for the same distance. Over the course of a year however, the A3 Sedan’s road tax of $392 would still be cheaper than the fuel savings the Model 3 can offer due to its hefty $3,248 road tax.

The world’s best-selling EV, the Nissan Leaf, might be of comparable value to the Audi A3. Given similar performance figures, the Leaf would overall be cheaper to maintain versus the 1.0L Audi A3. Like-wise, electric variants such as the Kia Soul EV and Hyundai Ioniq Electric may be suitable alternatives with manageable costs and ranges. However, the added nuances of range anxiety, lack of charging infrastructure and potential battery deterioration over time make it less compelling to jump into the EV bandwagon for now.

Compared to 2011 when Tesla decided to pull out without selling a single car, the brand is a lot more valuable today and the demand for Tesla cars have grown much stronger since. Even Mr Joe is a living example of beating the odds to be able to drive one in Singapore – and that happened years after Tesla pulled out. Given such demand, it is likely that they will be back. It might be even possible for Tesla to find a way to circumvent the road tax by limiting the motor output on its Teslas, or simply using less powerful electric motors – that could work.

Credits:

Get the Best Price for your used car

from 500+ dealers in 24 hours

- Convenient and Hassle-Free

- Consumer Protection

Transparent Process

With No Obligation