Electrifying 250 Million Cars. An Impossible Dream? Nissan Thinks Otherwise.

Nissan looks to electrification of personal mobility, in efforts to address global climate change. On 4 February, from one of the region's major automotive manufacturing countries, Thailand, the Japanese manufacturer uncovered their roadmap to electrified mobility for Southeast Asia.

Nissan looks to electrification of personal mobility, in efforts to address global climate change.

On 4 February, from one of the region's major automotive manufacturing countries, Thailand, the Japanese manufacturer uncovered their roadmap to electrified mobility for Southeast Asia.

While businesses in different sectors have introduced their very own green initiatives over the years; be it from a heavier emphasis on using recyclables, or even using recycled materials in their products; the other main environmental challenge that many automotive manufacturers like Nissan see the urgent need to address is climate change.

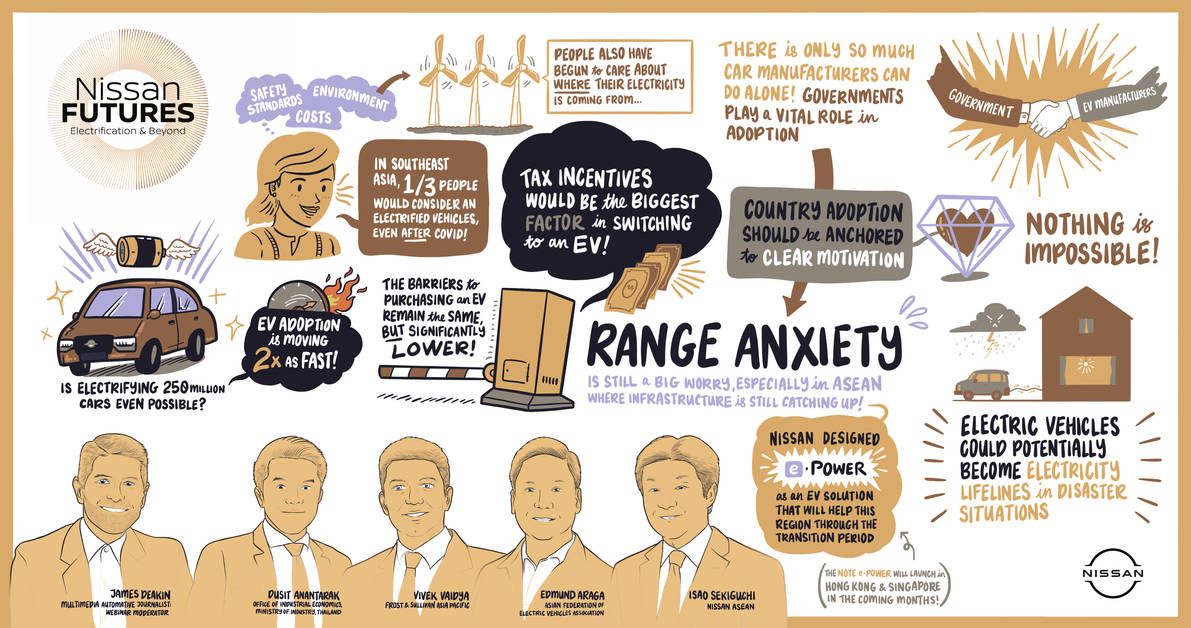

Climate change may be the biggest accelerator for manufacturers to make a switch to greener solutions, but with the automobile deeply entrenched as part of the fabric of developed and developing nations, there are real barriers for change.

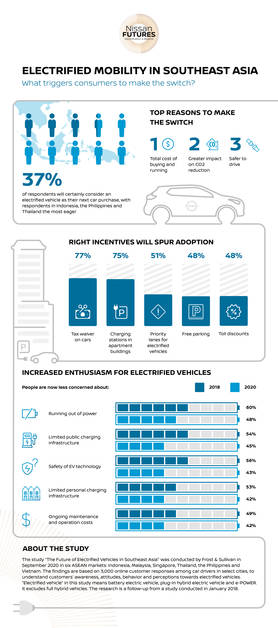

Getting to the root of this, Nissan commissioned a study by Frost & Sullivan to further understand what are the needs of car buyers within our region. Consumers surveyed in 2018 cited reasons like an overall lower purchase and running cost, a greater impact on CO2 reduction and a vehicle that is safe to drive, as their main motivations to make a switch to going electric. In the Philippines, Indonesia and Thailand, respondents were more willing to make the switch than the rest of the region. Incidentally, their countries’ major cities are the ones that tend to face heavier air and noise pollution issues.

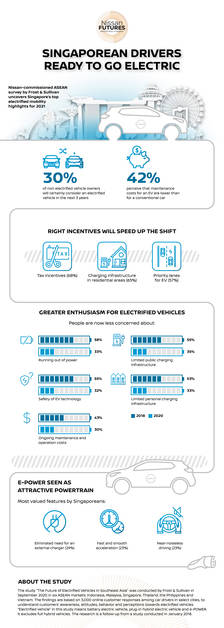

However due to the COVID-19 pandemic, there has been a significant shift in mindsets from most respondents when polled again in 2020. In 2018, 51% of respondents polled within the ASEAN region were willing to make the switch to an EV, but just two years later, this number dropped to 37%. Among all the ASEAN countries polled, Singapore bucked this trend slightly, with 30% of respondents stating that they would certainly switch to buying an EV; 1% more than in 2018.

Nissan’s commitment to reduce emissions comes around a time where the Singapore government has singled out climate change requiring our utmost urgent attention. Nissan’s efforts can be witnessed with their present-day product line. This includes cars like their second generation LEAF EV, that now covers practical real-world distances on a full charge; the Kicks Crossover and Serena MPV e-Power cars, or otherwise known as Series Hybrids. The two cars, unlike the full hybrid vehicles we are familiar with, utilises its batteries to drive the car, and both have a small 1.2 litre engine, functioning as a generator to charge the battery. There will be a third e-Power vehicle to join this range soon, when Tan Chong, Nissan’s dealership here releases the new Note small hatchback. By 2022, Nissan will be adding eight EVs to their line-up.

Currently, our island nation has about 1,700 electric charging points, to support approximately 0.2% of our population of cars that are electric. There is a targeted roll out of at-least 28,000 points by the year 2030. With our country moving to phase out the sale of ICE cars by 2040, and for every passenger vehicle to be able to plug-in at night, more has to be done.

But the encouragement of buyers to make a switch to an EV cannot be simply mere lip service from manufacturers, their dealerships or even respective country governments. A Nissan study notes that governments have to provide incentives for adoption. Respondents to their survey cited tax waivers and sufficient charging stations, especially in apartment buildings, as the main incentives to spur adoption. Other incentives that weigh heavily on their wishlist include, priority lanes for Electrified Vehicles (a rather difficult measure to implement in Singapore), free parking and discounts on toll roads.

With EVs increasing their presence within our region, there has been a change in how they are viewed. In a span of two years, from between 2018 to 2020, the shift in mindsets, have seen potential buyers worry a little less about issues like Range Anxiety, limited public and personal charging infrastructure, safety of EV technology and overall running costs.

The increased adoption of an EV should offer owners a similar user experience to their current ICE cars. From how they are priced, how long and often they need to be charged (especially on longer journeys up North, compared to visiting the pumps), and as-mentioned earlier, overall running costs.

Our power supply infrastructure will also need to see change, since there will eventually be a heavier load on the network, and pollution will shift from our car population, to our power plants. Companies like Sunseap, which is currently building infrastructure to harness solar energy has begun selling their green energy to households. They are also behind the Charge+ EV charging service, and have introduced their Ultra-Slim Charger, which looks like a promising fit for some of our tight HDB and Condominium carparks. It does not take much to join the dots since they are a solar energy service provider.

Smaller EVs, similar in size to a current-day compact car, would potentially offer lesser mileage, since there is limited room on-board for a larger battery. The generation one Nissan LEAF which delivered an approximate maximum range of 120km, now delivers about twice the mileage or more with the second generation car. We can be sure that even in a decade from now, battery technologies will be more advanced, improving on two key issues we face today, which are capacity, and weight.

While we have quite a way to go for improved infrastructure, things are beginning to look rosy for Tan Chong in Singapore. With the increased VES and additional EEAI incentives that kicked-off on 1 January 2021, they have seen positive development and take-up rate, with five LEAF EVs sold just in the month of January, the same number of LEAF EVs sold for the entire year of 2020. Enquiries and test drives of LEAF have also jumped by more than three-fold compared to the same period last year.

Nissan’s e-Power models have also seen a positive takeup, with more than 1,200 Serena and Kicks vehicles plying our roads. The introduction of the new Note e-Power, Nissan’s entry e-Power model, would mean that they are able to bring Nissan’s innovative e-Power technology to an even wider audience, making its benefits even more accessible.

Credits:

- Convenient and Hassle-Free

- Consumer Protection

Transparent Process

With No Obligation

Get the Best Price for your used car

from 500+ dealers in 24 hours