COE Trend Spotting - Where The Car Market In Singapore Is Headed

It is an understatement to say that the car market in Singapore is unique. When describing the way it works to foreigners, baffled, flabbergast reactions and expressions are usual responses, especially when the tax structure is explained and they slowly comprehend just how many more layers are added on top of the base vehicle price as charged by the manufacturer.

It is an understatement to say that the car market in Singapore is unique.

When describing the way it works to foreigners, baffled, flabbergast reactions and expressions are usual responses, especially when the tax structure is explained and they slowly comprehend just how many more layers are added on top of the base vehicle price as charged by the manufacturer.

And as much as this is often the central focus of the car market in Singapore, where everyone is perpetually obsessed with the premium costs of the Certificate of Entitlement (COE), there is actually a sort of predictability with the 10-year system.

The fact that each car is tied to a statutory 10-year lifespan with possible five or ten year extensions coupled with the zero car growth policy creates a one-for-one replacement market, which makes it possible therefore to look at historical data to predict future trends.

To put it into perspective, we will look at three key annual data sets – vehicles registered, vehicles deregistered and COE renewals over the last decade or so. Since the market cannot register more cars than the supply of COEs, and the supply of COEs is tied directly to vehicles deregistered, these three data sets can be used to analyse COE trends in the coming years.

While it is impossible to predict with absolute certainty where the market will head because of other possible external factors such as yet another impromptu policy shift or implementation (think things like overnight loan cubs, implementation of emissions taxes and so on), we will consider what the data shows us and explore some future trends which could explain what is happening now, and what may happen next.

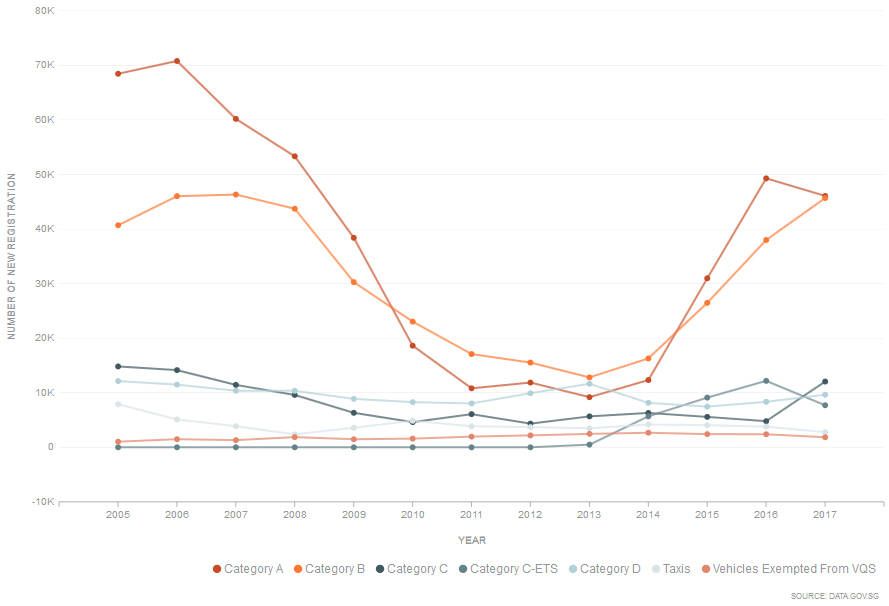

We first look at vehicle registrations since 2005, and you’ll notice that there’s a general downtrend from 2005 all the way to 2013, where it hits rock bottom and if you’ll recall, where COE premiums soared as high as over $90,000. And just to keep things relevant, we’ll look mostly at passenger cars this time; that is namely in Categories A and B.

You’ll also see that the steepest drop in registrations where between 2008 and 2010, where numbers plunged well below the 30,000 units. Between 2010 and 2013 the numbers continued to fall of course, but the rate slowed and there was some stability in the market, albeit a weak market it was at the time.

Why is this significant? Because we are in approaching this period 10 years later, which means that most of the vehicles registered in that period would have been scrapped. Some would have their COEs renewed, but we will look at that later.

Which in turn translates to this – with so few cars registered (and heading to be de-registered soon, it can only mean that the supply of COEs upcoming from 2020 through to 2023 will be correspondingly low as well.

This then spells a possible spike in premiums prices over the next few years.

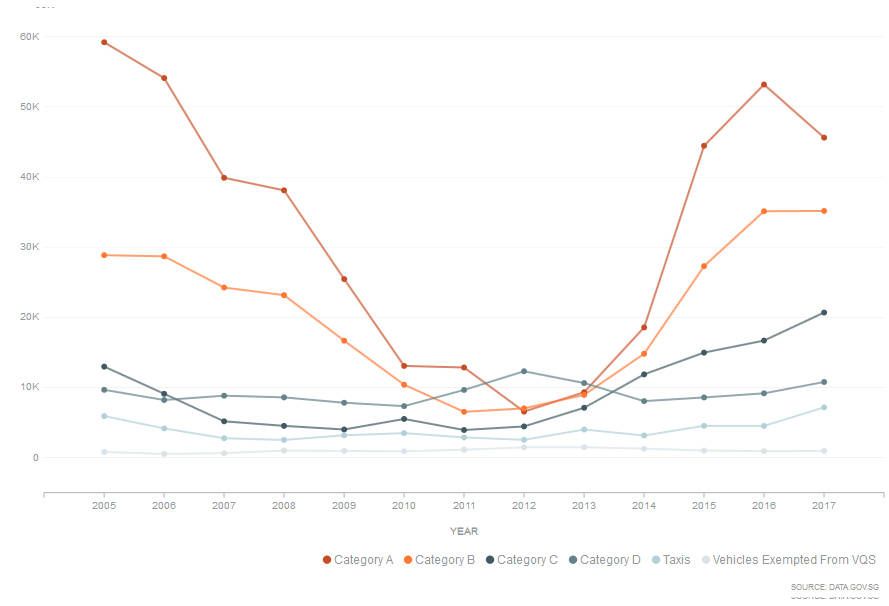

When we then consider the corresponding de-registration figures, we can see that the trend follows as well. Where there are more de-registrations there are more new registrations. The period of 2010 to 2013 showed a correspondingly low de-registration rate, which supports the low registration rate as fewer COEs are returned to the pool.

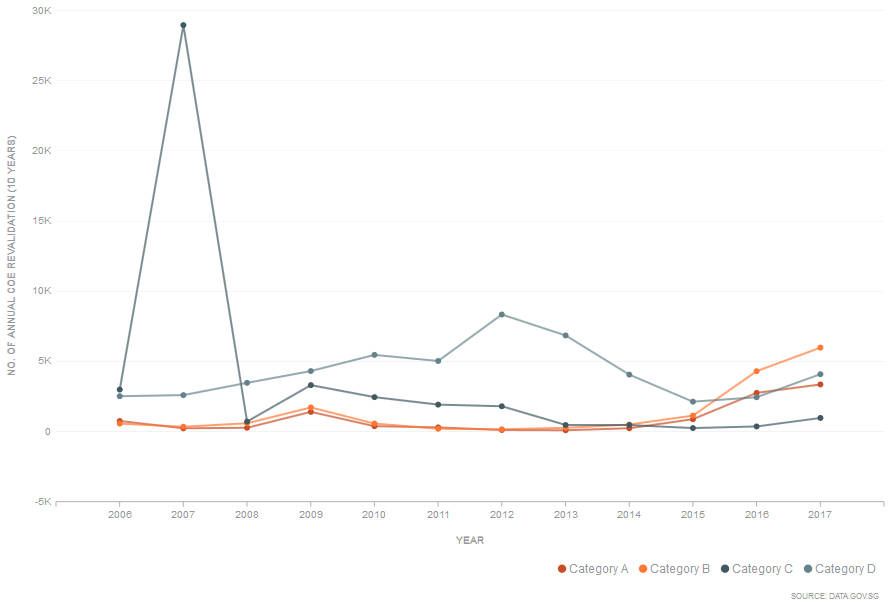

And when we look at the COE renewal rates, they are consistently low and should have limited impact on the overall premiums pool historically. But from 2014 onwards, there has been a steady rise in renewals, which suggests that more car owners are opting to keep their cars for longer.

If this trend keeps up, the increased renewals may lead to yet fewer COEs being returned to the pool for new registrations, and increasing the scarcity.

All of this brings us to the perpetual question – when is it the right time to buy a new car? At the moment, it would appear that while premiums remain fairly low at the moment, one might seize the opportunity if one is in the market for a new car.

Although this data trend is merely that, a trend; and other factors may yet contribute to further increase or decreases in premium prices, it appears that we are headed to yet another COE scarce period which should theoretically mean a spike in prices.

Fig 1. - Annual Vehicle Registration by COE Category

Fig. 2. - Annual De-registration by COE Category

Fig. 3. - Annual Revalidation of COE of Existing Vehicles

Credits:

Get the Best Price for your used car

from 500+ dealers in 24 hours

- Convenient and Hassle-Free

- Consumer Protection

Transparent Process

With No Obligation